Data tokenization tools safeguard data and help businesses comply with privacy and security laws, including GDPR, CCPA, and PCI DSS. Often used to secure financial records, bank accounts, medical records, and various other forms of personally identifiable information (PII), the tokenization of data offers unmatched protection against sensitive internal and external data breaches. This glossary covers the benefits of this critical security tool.

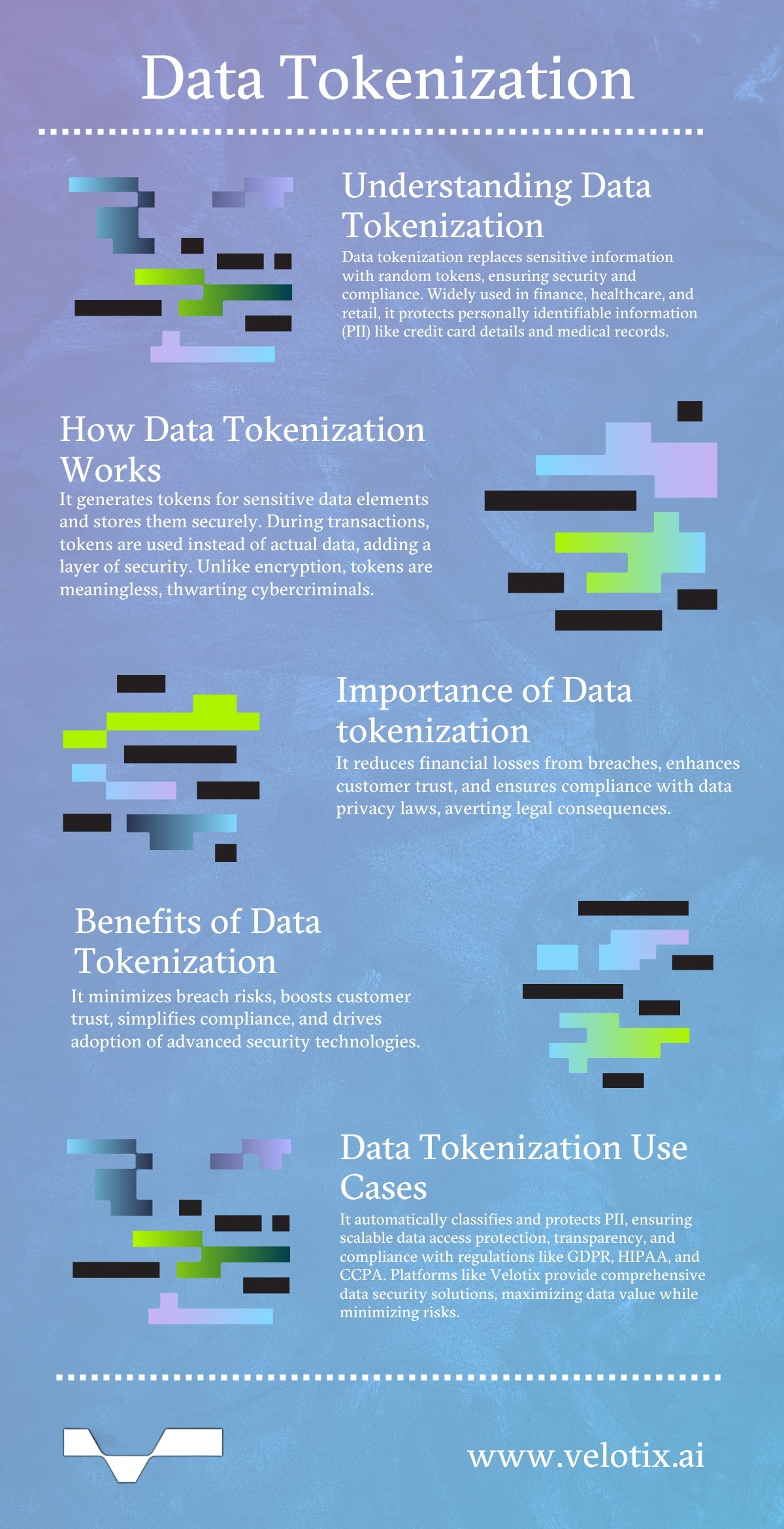

What is Data Tokenization?

Tokenization transforms meaningful pieces of data into random strings of characters known as tokens. It safely replaces sensitive customer information with numbers, letters, and symbols and stores the original data in a “virtual vault.”

The tokenization process occurs when data is submitted. For instance, when someone taps, swipes, inserts, or types manually into a terminal a credit or debit card. When a token is presented in place of the card’s original information, the virtual vault matches it to the user’s “live” card information and applies the payment to an account.

Tokens have no meaningful value; they serve only as substitutes for data. More importantly, they do not use cryptography, meaning bad actors can’t use tokens to guess the original data.

Data tokenization tools or platforms allow businesses to protect cardholder data and adhere to industry and governmental regulations with minimum liability and security expenses. Typical technology users include:

- Financial institutions and banks

- Real estate firms

- Retailers

- Healthcare providers

- Insurance providers

- e-Commerce businesses.

Data tokenization is a two-step process:

- A tokenization system generates tokens for each sensitive data element.

- Encrypted tokenized data is stored in a database or other storage repository.

Why is Data Tokenization Important?

Tokenization protects businesses from the negative financial impacts of data theft. In effect, it makes valuable personal data virtually invisible. So, even if a breach occurs, sensitive information isn’t available for cyber thieves to steal. While tokenization can’t protect a business from actual data breaches, it can be useful in reducing the fallout from potential breaches.

Unlike data masking, which is used to protect data “in use,” tokenization primarily protects “at rest” data.

Because no “live” customer data is used in the transaction, cyber thieves can’t intercept it. And even if they could obtain the token, it would be useless to them unless they had access to the token data vault.

This matters to your organization for two critical reasons:

- Reduced business risk. For business owners, tokenization significantly reduces the risk of exposure when handling customer credit or debit card data. Lower risk is always beneficial to your company’s longevity and security.

- Reputation. No business wants to tell its customers that their data was breached. With up to 60% of companies affected by a data breach likely to go out of business due to customer trust issues, tokenization ensures customers’ security and privacy are maintained.

Lastly, data tokenization ensures organizations comply with international data privacy laws that regulate the manner in which information is collected, how customers and clients are informed, and what control people have over their data. Failure to adhere to data privacy laws can lead to lawsuits, fines, and penalties. In some cases, it can result in a company being permitted to operate in certain jurisdictions.

Benefits of Using Data Tokenization

While this glossary uses credit and debit cards to illustrate the benefits of tokenization, it’s important to note it also applies to any PII, including passwords, emails, and customer accounts and files. For example, password tokenization replaces original passwords with tokens. When someone enters their password during the authentication process, the tokenized password is compared to the stored token to verify its correctness. Tokenization can also be used with databases, allowing businesses to protect data in bulk.

The primary benefits of data tokenization include:

- Reduced risk from data breaches. A data breach can translate to direct revenue loss for businesses as customers move to competitors. Tokenization offers maximum protection of customer payment data.

- Fosters customer trust. Many people still don’t feel safe making online payments. Data tokenization makes their PII less vulnerable to cyberattacks and fraud.

- Minimizes compliance red tape and penalties. Businesses that suffer a data breach can face lawsuits, penalties, and fines for non-compliance with payment security standards. Tokenization ensures compliance on all levels.

- Drives technology adoption. Older point-of-sale and other database systems allowed the free exchange of PII over networks. PCI-compliant businesses keep customer data safe using the latest tools and technologies.

Data Tokenization Use Cases

A data tokenization platform lets you classify data as PII and automatically restrict data viewing. Velotix helps organizations maximize business value by removing silos and making data attainable while minimizing security risks.

Our Data Security platform makes enforcing access restrictions and privacy control a more straightforward process.

- Scale data access protection. Robust security measures help organizations accommodate an increase in data and users, ensuring data remains protected as a business grows and expands.

- End-to-end visibility and transparency. Various obfuscation and anonymization techniques are employed, including masking, partial masking, hashing, bucketing, and row-level filtering. Businesses have increased visibility into a token’s path, which helps ensure accountability, effective auditing, and compliance.

- Industry-standard compliance. Our rulebook understands the intricacies of global privacy regulations, including GDPR, HIPAA, and CCPA. By achieving industry-standard compliance, organizations prove their commitment to protecting PII and meeting industry and regulatory requirements.